To remain significant in a quickly developing loaning market, monetary loaning organizations should be future-prepared. They need to embrace innovation and practices with a drawn out skyline. Moreover, business processes at the loaning firm ought to be sufficiently flexible enough to accept changes in the always moving administrative scene in the space.Making use of automated credit decisioning system simplifies almost every task of loan firms.

Here is what you must do to take your lending business to the next level. They are as follows,

- While it might seem like an errand, future-proofing a loaning business need not be upsetting, tedious or costly by any stretch of the imagination. There’s no need to focus on taking progressive jumps however about remaining pertinent reliably on the lookout. Coming up with future-proofing thoughts for a loaning firm isn’t quite as hard as it sounds, by the same token.

- For a loaning firm planning to future-confirmation themselves, paying attention to your clients is like a no brainer yet the most important plan to remain ahead. Organizations need to utilize formal arrangements set up to effectively following the criticism that borrowers are sending. This helps structure a noteworthy system for what’s in store.

- While the client is the ruler, regularly loaning firms need knowledge into client conduct which inturn means ruin. Most loaning business today take the advanced course to accomplish effectiveness. Powerful conveyance of computerized administrations must be conveyed by understanding how a few practical regions work in coordination inside, freely and with clients.

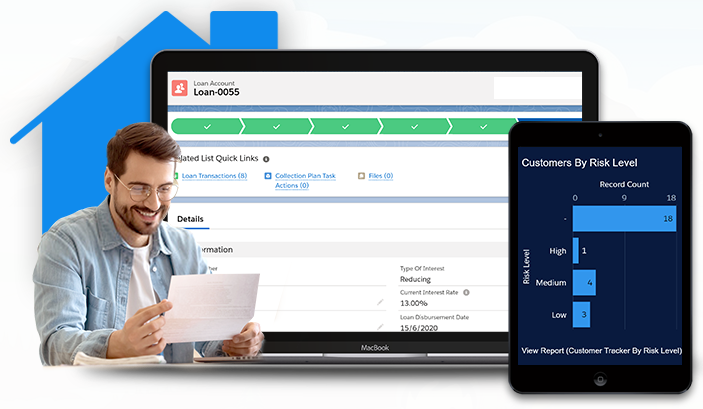

- High level Artificial Intelligence innovation as AI can help monetary loaning firms accomplish the ideal degree of mechanization and embrace a client first methodology. It makes it feasible for a loaning business to convey top notch monetary administrations at speed via cautiously expecting client needs, needs and wants. Try to incorporate automated credit decisioningsystem into your business which will ensure that your business will stand through the future problems and any kind of struggles because of other companies. Early usage of this technology is one of the best things any lending firm owner would do.